Strona główna » Products and services » VAT Payer Verification

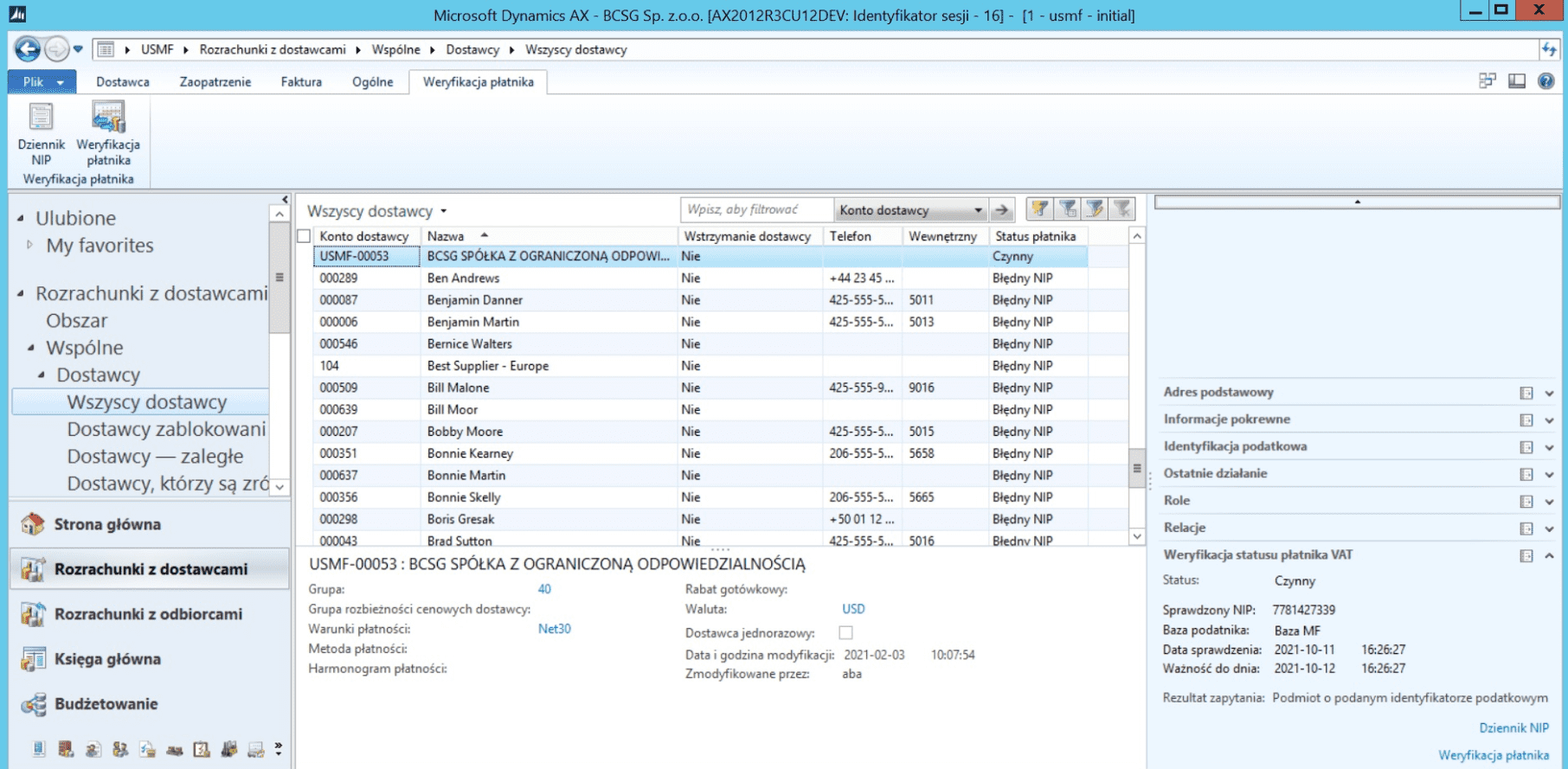

This solution allows the user to obtain a confirmation whether a counterparty is registered for VAT in the register maintained by the Polish Ministry of Finance. The functionality makes it possible to check the VAT registration status directly at the Microsoft Dynamics AX/ Microsoft Dynamics 365 system level.

Are you looking for tried-and-tested solutions?